Implementing a Legacy System into an Modern Bank App

goal

The main challenge for Bradesco was to integrate a complex, legacy system into a new application designed for high-income account managers. This app needed to streamline the account opening process, making it accessible and user-friendly for both clients and managers.

context

We were tasked with incorporating the bank's account opening system into a specialized app for bank managers handling high-income accounts. The complexity of implementing one of the company's most intricate services was daunting. It involved coordinating with multiple departments and integrating security and fraud prevention systems, all while creating a user experience that made sense to both the client and the manager.

process

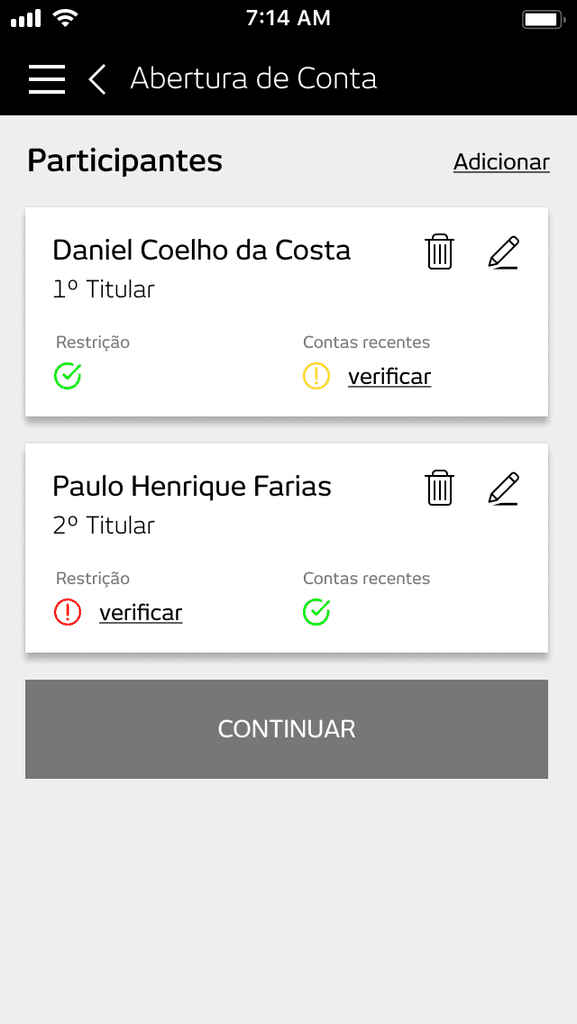

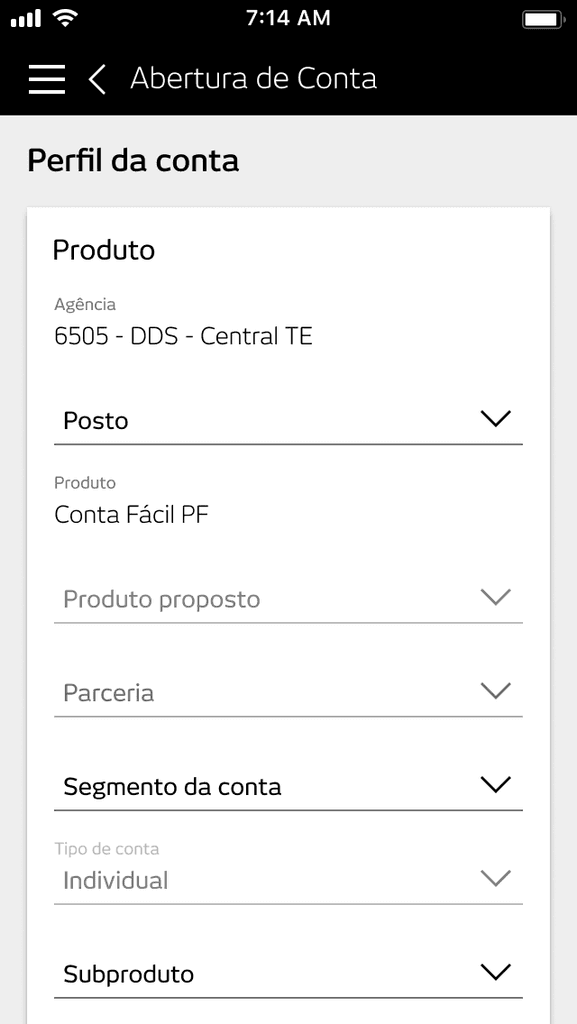

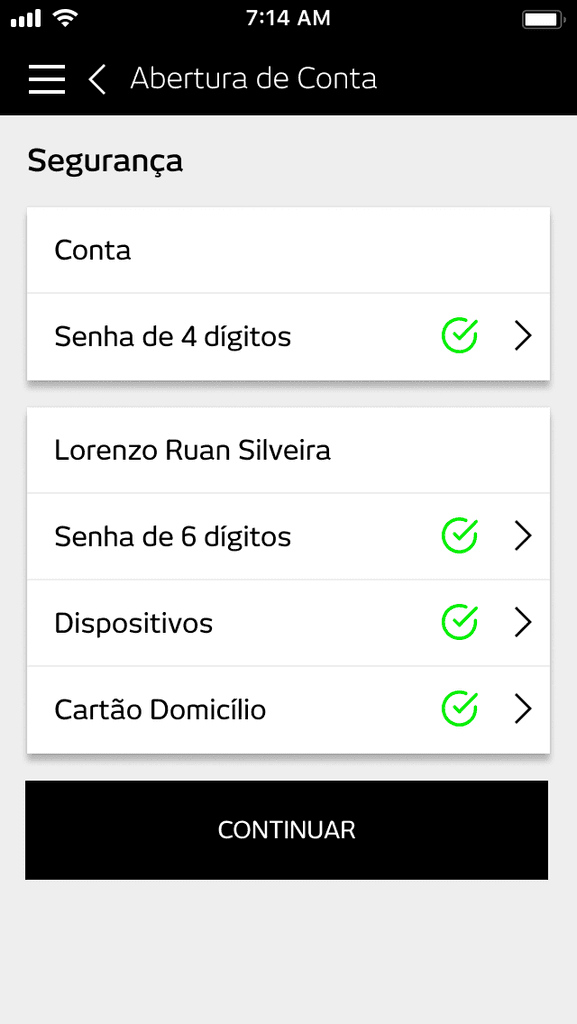

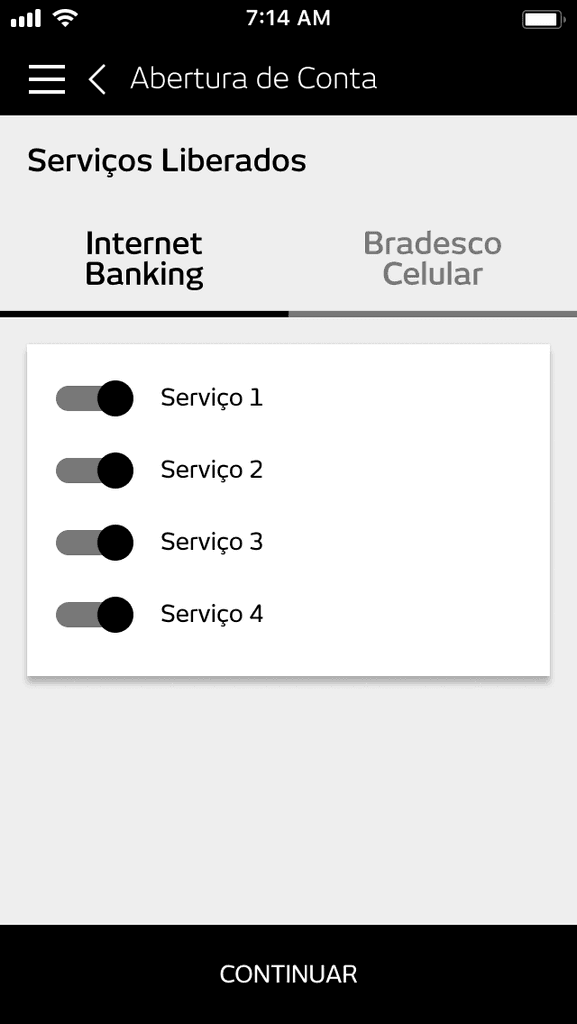

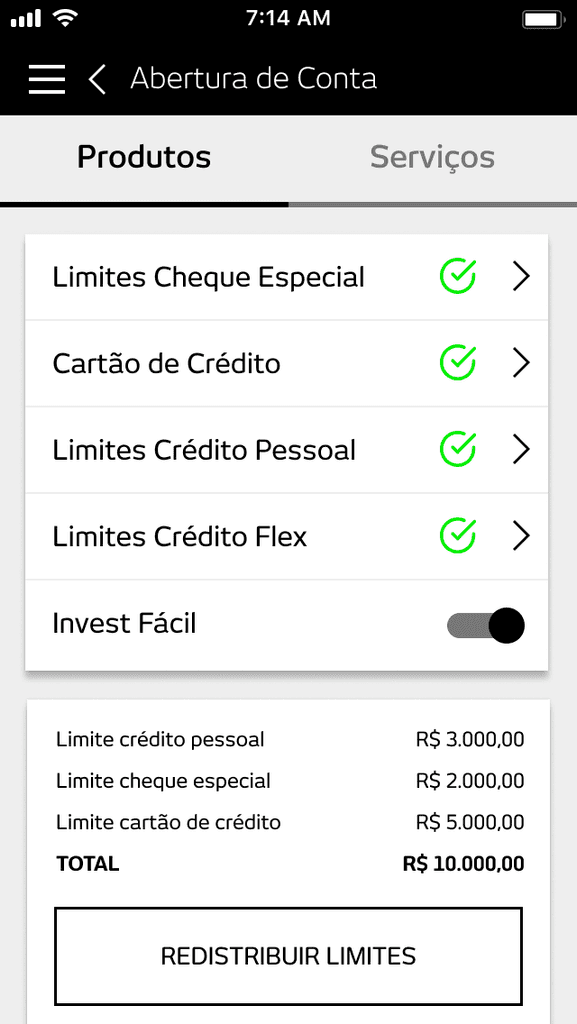

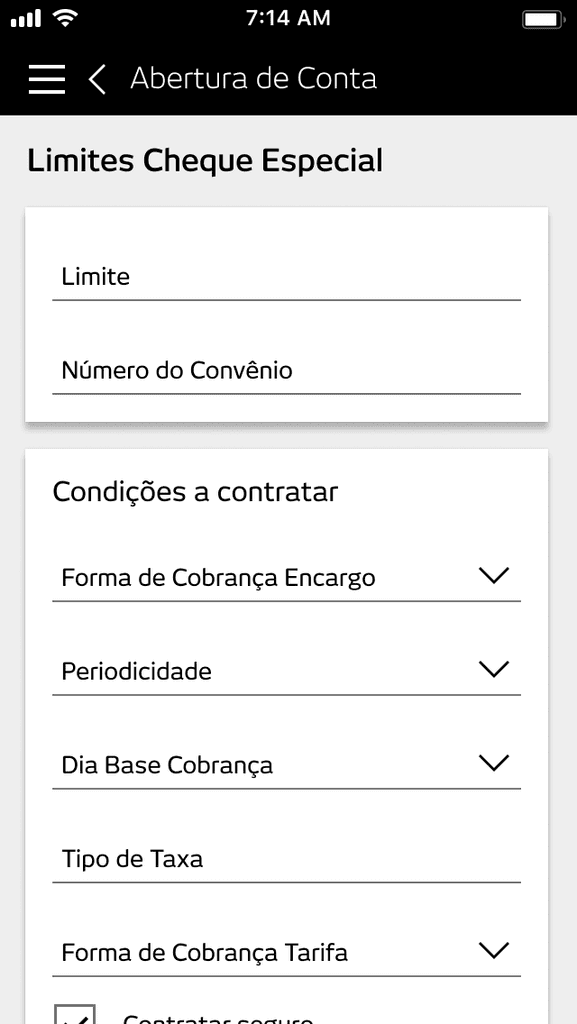

Our journey began with dissecting the account opening system to understand which steps could be moved online and which needed to be in-person. We identified the departments responsible for each stage, including customer data, fraud, security, credit card services, and additional services.

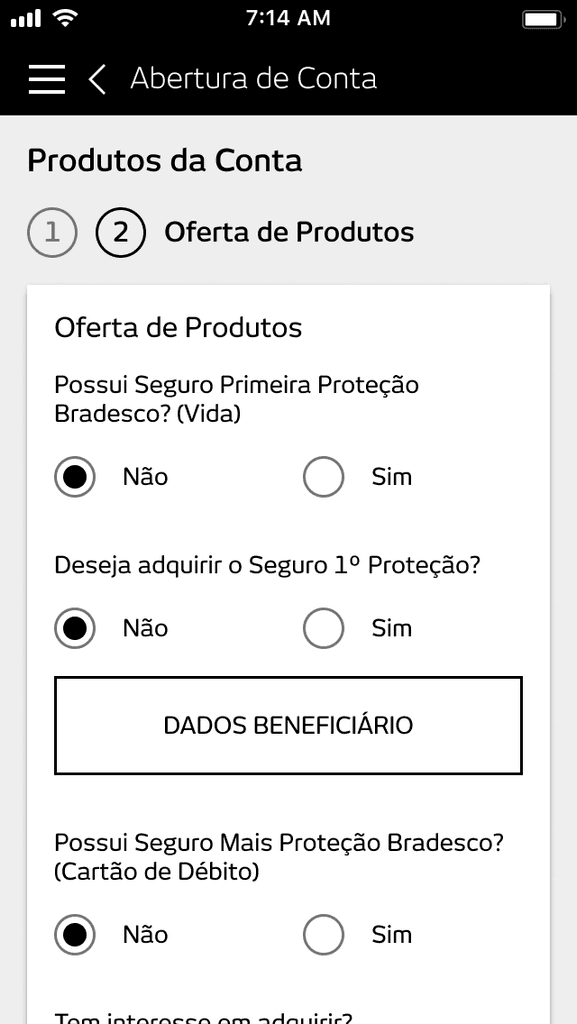

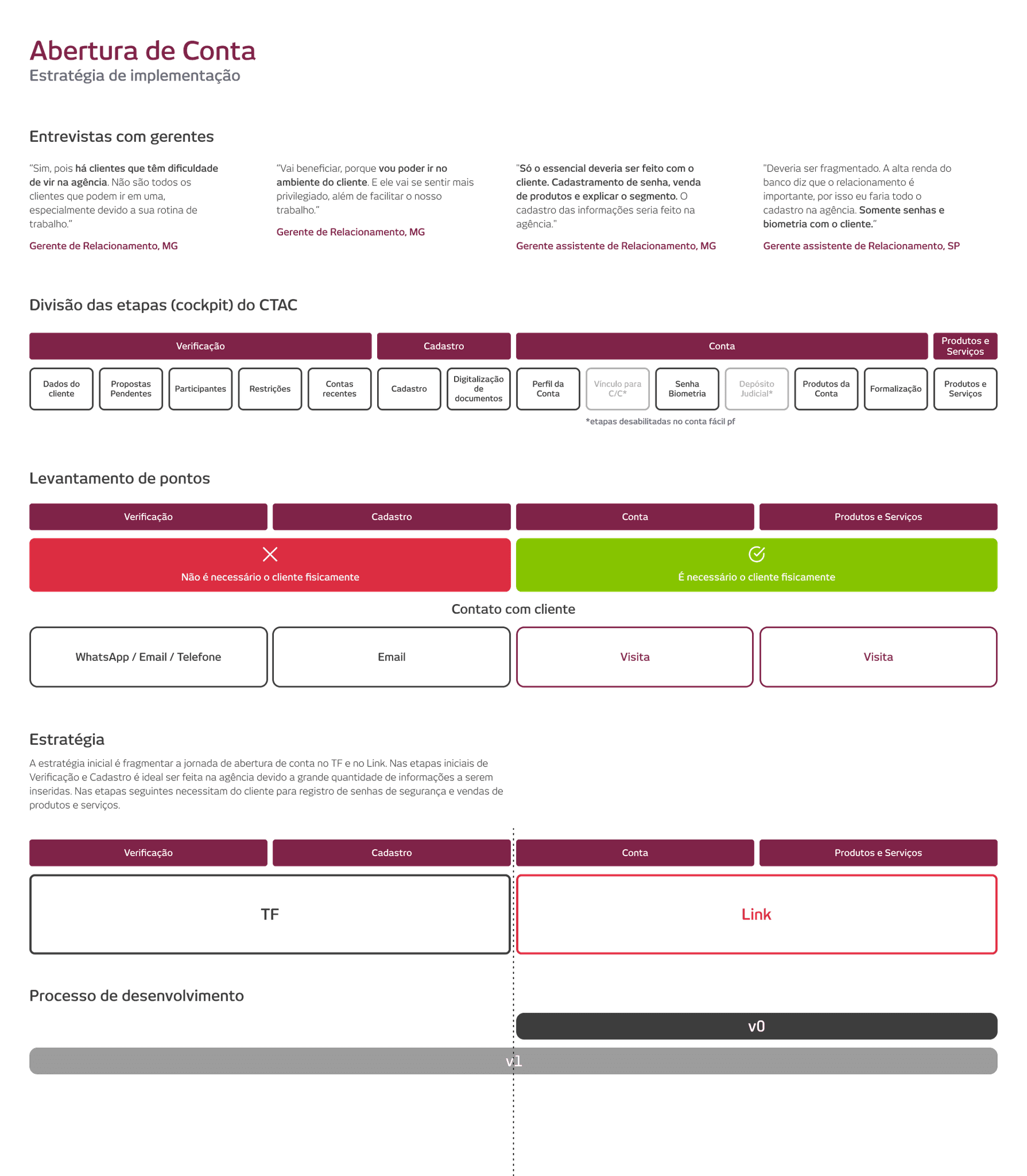

implementation strategy

current system for opening account

The first step required us to pitch the idea to each department, explaining our rationale and then creating dynamics to gather crucial information from each process, aiming for a consensus on necessary adaptations.

We organized several workshops involving various stakeholders, where everyone contributed insights to identify the best solutions.

Initial workshops

Gradually, we developed an initial outline of the account opening journey. To validate this process, we interviewed bank managers in both São Paulo and smaller cities, gaining insights into the operational realities of their daily tasks. This helped us map out the customer service journey, pinpointing pain points and procedural bottlenecks, crucial for understanding the real issues faced by our primary users: the managers.

Account manager journey map

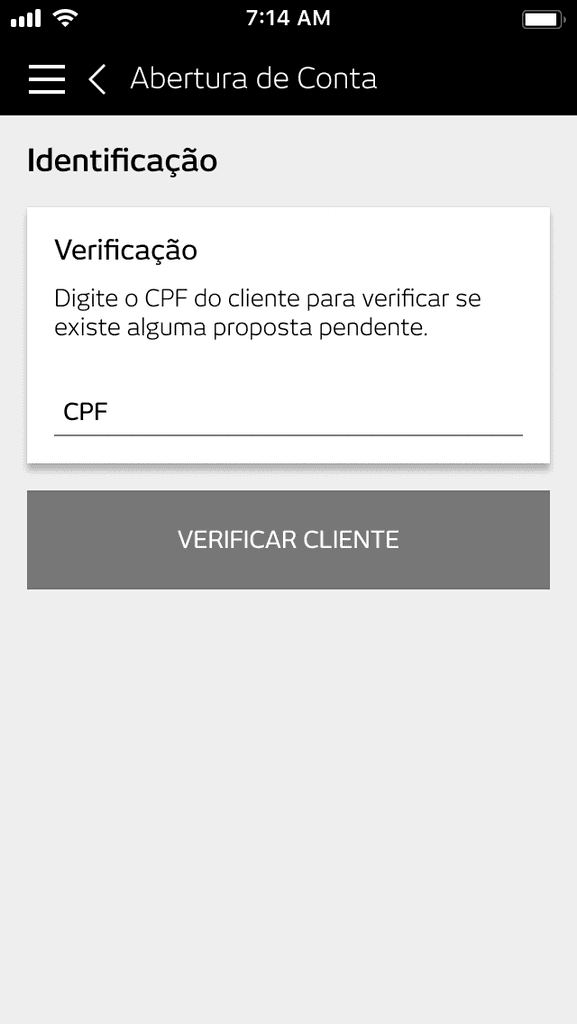

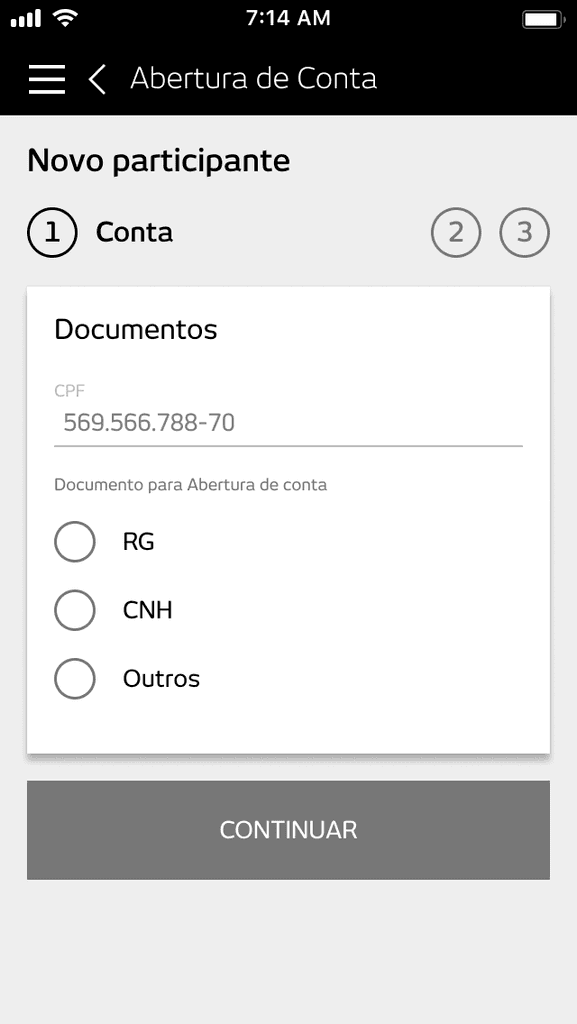

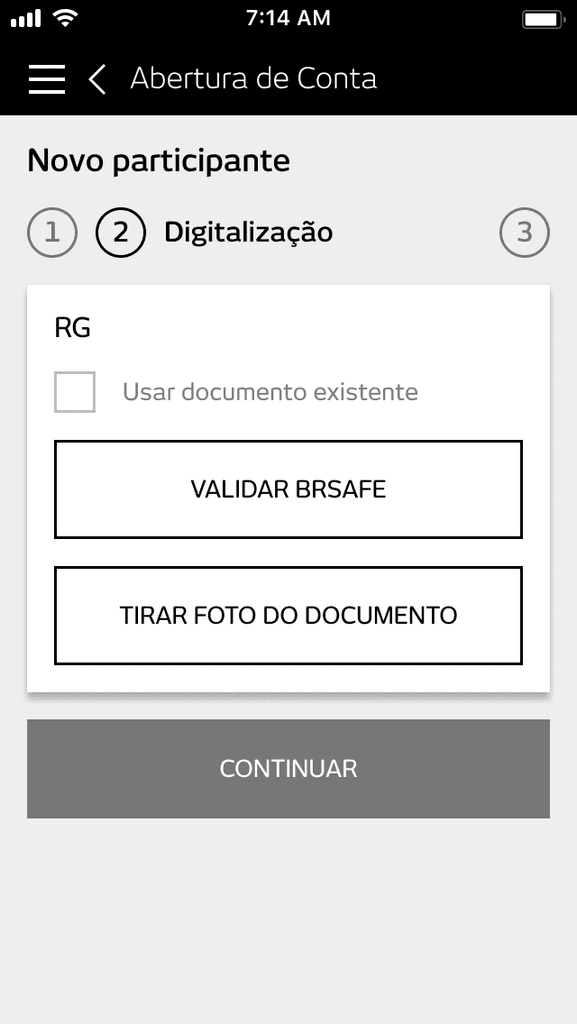

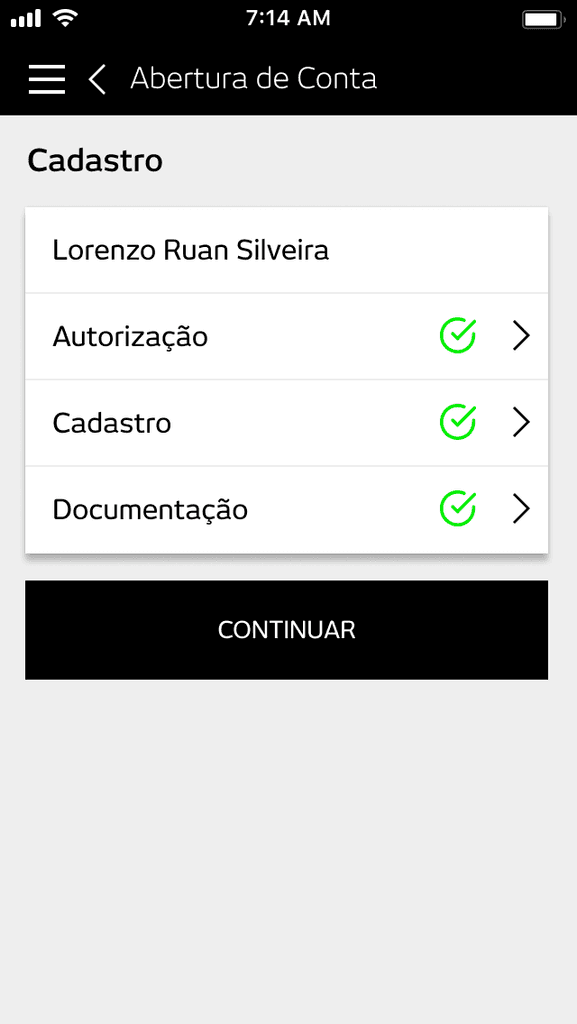

Armed with this journey map, we began creating the first wireframes, considering where they fit into the manager's journey and identifying the requirements and jobs to be done at each step. We also assessed the feasibility of each stage with the respective departments, weaving together the diverse requirements into a coherent information architecture that addressed the problem.

Wireframe

validating with other departments

Validating these components, we then built the first prototypes to test with our main users, the bank managers. Returning to the field, we interviewed both previous participants and new ones to avoid cognitive bias. The feedback was overwhelmingly positive; despite some less-than-ideal processes like biometric verification requiring in-person visits, we addressed over 90% of the pain points for high-income account managers, who often lack the time to visit the bank.

Account manager journey map

In addition to the main account opening project, there were several smaller initiatives within the same application that embarked on their own discovery and creation journeys. One particularly enjoyable project focused on the "Pipeline" - essentially a scheduling system for B2B and B2C manager visits to clients. To tackle the concept of a calendar/schedule, I crafted a low-fidelity physical prototype using paper and post-it notes. This approach provided a tangible way for stakeholders to grasp the journey before transitioning to the digital realm. It was a fascinating process to translate a digital journey into a physical medium, fostering a shared understanding and facilitating stakeholder engagement from the outset.